trust capital gains tax rate 2020

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. Over 2600 but not over 9450.

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

It applies to income of 13450 or more for deaths that occur in 2022.

. Discover Helpful Information and Resources on Taxes From AARP. The tax rate works out to be 3146 plus 37 of income. However long term capital gain generated by a trust still.

For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. This along with the rate reduction may reduce the tax paid by ESBTs on S corporation income from a maximum of 396 in tax year 2017 to a potential effective rate of.

The trustees take the losses away from the gains leaving no chargeable gains for the. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150. An individual would have to make over 518500 in taxable income to be taxed at 37.

Qualified dividends are taxed as capital gain rather than as ordinary income. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing a 1041 tax return. What is the capital gains tax rate for trusts in 2020.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. 2022 Long-Term Capital Gains Trust Tax Rates.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. 4 rows The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets. For tax year 2020 the 20 rate applies to amounts above 13150.

The trust has the following 2020 sources of income and deduction. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. 40 of R160 00000 is included in the taxable income of the individual.

Events that trigger a disposal include a sale donation. The standard rules apply to these four tax brackets. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a.

In situations where the. Trust tax rates are very high as you can see here. This amount is taxed at that individuals marginal tax rate.

For example if a trust has taxable income of 13000 in 2019 and then subsequently makes a distribution of 13000 to a beneficiary within the 65-day window in. 58 930 28 of the amount above 550 000. The highest trust and estate tax rate is 37.

For tax year 2020 the 20. Ad Compare Your 2022 Tax Bracket vs. 10 of 2650 all.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. In 2020 to 2021 a trust has capital gains of 12000 and allowable losses of 15000. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150.

Your 2021 Tax Bracket to See Whats Been Adjusted. Capital gains and qualified dividends. So for example if a trust earns 10000 in income during 2021 it would pay the following taxes.

45 x R64 00000. 10 percent of taxable income. At basically 13000 in income they hit the.

The tax rate works out to be 3146. The trustee of an irrevocable trust has discretion to distribute income including capital gains. The 0 rate applies to amounts up to 2650.

The 2020 rates and brackets for the income of an Estate or trust. The maximum tax rate for long-term capital gains and qualified dividends is 20. For the 2020 tax year the first 2650 of capital gains earned by trusts are not taxed and there is a 15 tax rate for gains above this amount up to 13150.

Capital Gains Tax Rate. Individuals 18 2021 2020 Companies 224 2021 2020 Trusts 36 2021 2020 Capital Gains Tax. If taxable income is.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Tax Form 8949 Instructions For Reporting Capital Gains Losses Capital Gain Capital Gains Tax Tax Forms

9 Expat Friendly Countries With No Capital Gains Taxes

Pin By The Taxtalk On Income Tax Investing Capital Gain Capital Assets

9 Expat Friendly Countries With No Capital Gains Taxes

Many Property Owners Are Often Reluctant To Sell Because Of Capital Gains Taxes Associated With The Sale Is There Capital Gains Tax Capital Gain Tax Attorney

Benefit Of Capital Gain Exemption Could Not Be Denied Merely Because The Builder Failed To Hand Over Possession Of Flat To Asse Capital Gain Benefit Income Tax

Pdfcoffee Com Banggawan Qanda 456 Pdf Free

Pdfcoffee Com Banggawan Qanda 456 Pdf Free

Income Tax Diary Income Income Tax Tax

Tennessee Retirement Tax Friendliness Smartasset Com Federal Income Tax Income Tax Return Inheritance Tax

2021 Trust Tax Rates And Exemptions

Pricing Pulse360 Win Back Time Admin Work Meeting Notes Salesforce Integration

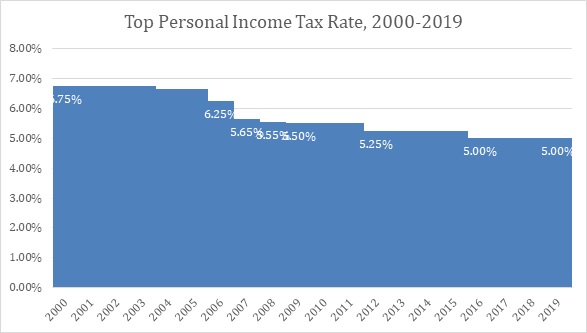

Individual Income Tax Oklahoma Policy Institute

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Avoiding Capital Gains Tax Strategies To Save You Thousands Live Q A Mark J Kohler Youtube

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)