salt tax repeal new york

Similar to Californias PTE tax election the Colorado PTE tax election is only allowed in an income tax year when the SALT cap is in effect for federal tax purposes ie tax years ending on or before December 31 2026 or earlier if the federal SALT cap is repealed sooner The tax rate for electing PTEs is 455. Due to the significant differences in the new tax code this year it is not possible to back port these specific fixes made to prior calendar years.

Among The Tax Bill S Biggest Losers High Income Blue State Taxpayers The New York Times

This year the fifth rate dropped from 609 to 597 percent and the sixth rate dropped from 641 to 633 percent.

. In response to the SALT cap a number of states like New York New Jersey and Connecticut created workarounds to assist their taxpayers hurt by the cap. A new salt tax was introduced to the Republic of India via the Salt Cess 1953 which received the assent of the president on 26 December 1953 and was brought into force on 2 January 1954. To amend chapter 174 of the laws of 1968.

CCH AnswerConnects expertly-written content covers all aspects of. Joe Manchin D-WVa blew it up last month say theres simply not enough. Education fund and the New York state community grants reinvestment fund.

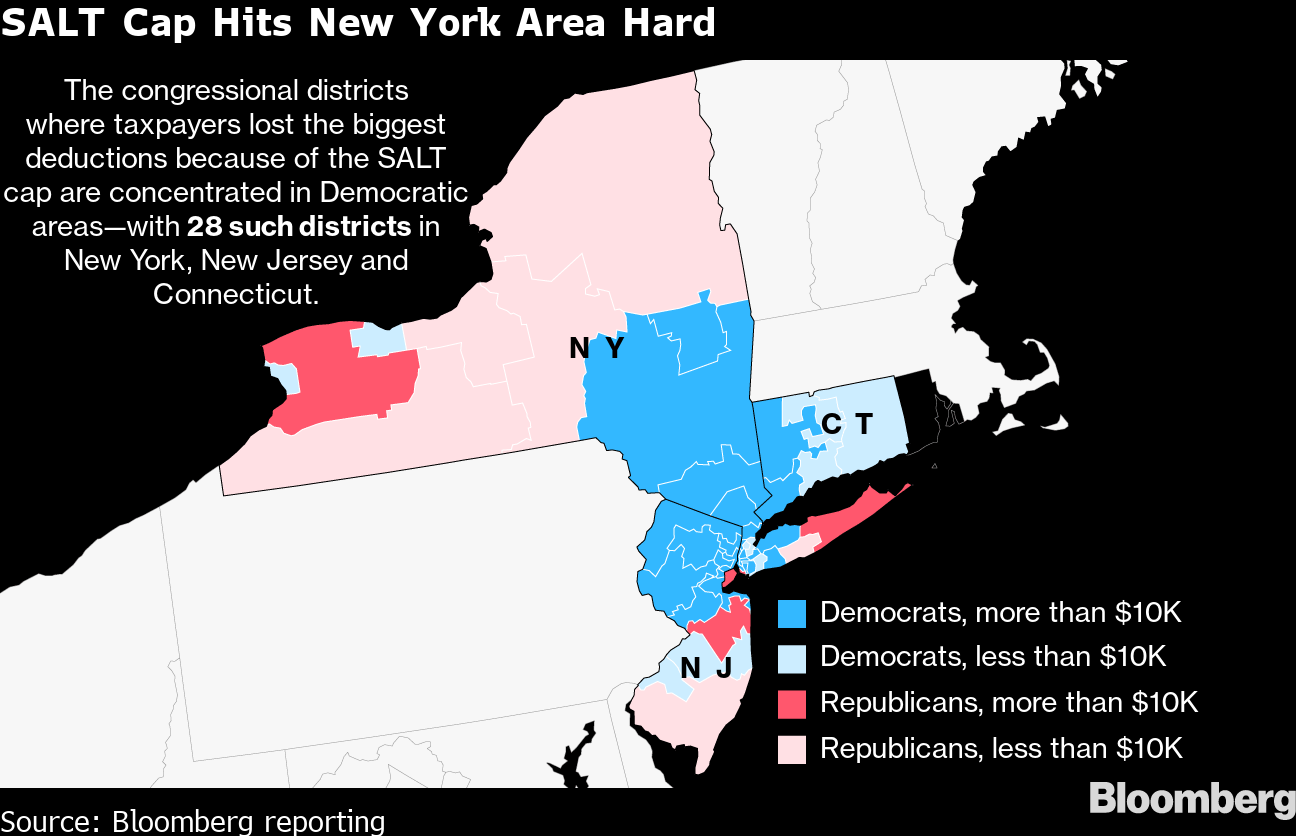

Then in December 2017 The Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 thereby limiting a taxpayers itemized deductions and tax benefits. The tax base is the sum of each electing PTE nonresident owners pro rata. To amend chapter 90 of the laws of 2014 amending the public health law the tax law the state finance law the general business law the penal law and the criminal procedure law relating to medical use of marihuana in relation to the effectiveness thereof.

Tax preparers like you are being challenged to rethink how they do business. Learn how tax offices are using cloud solutions like TaxWise Online to do more returns faster and work remotely. New York is continuing to phase in a reduction to its fifth and sixth marginal individual income tax rates.

Version 07 Beta 12212017 fixed the AMT taxable income calculation to account for all types of Schedule A deductions or the standard deduction. Senate Democrats say a proposal to raise the cap on state and local tax SALT deductions a top priority of Senate Majority Leader Charles Schumer D-NY is likely to be cut from the revised Build Back Better Act. As you look ahead to the future were here to help you navigate the new normal.

Just as in a previous attempt. Then again there is a still more wretched creature who bears the name of a laborer whose income may be fixed at thirty-five rupees per annum. Senate Democrats who were involved in negotiations over the bill before Sen.

The SALT repeal is included in President Bidens Build Back Better proposal which passed the House last year. If he with his wife and three children. Added nontaxable state income to the NIIT calculation.

Manchin has declined to say publicly how he feels about Schumers push to change the SALT cap which would be a major benefit for New.

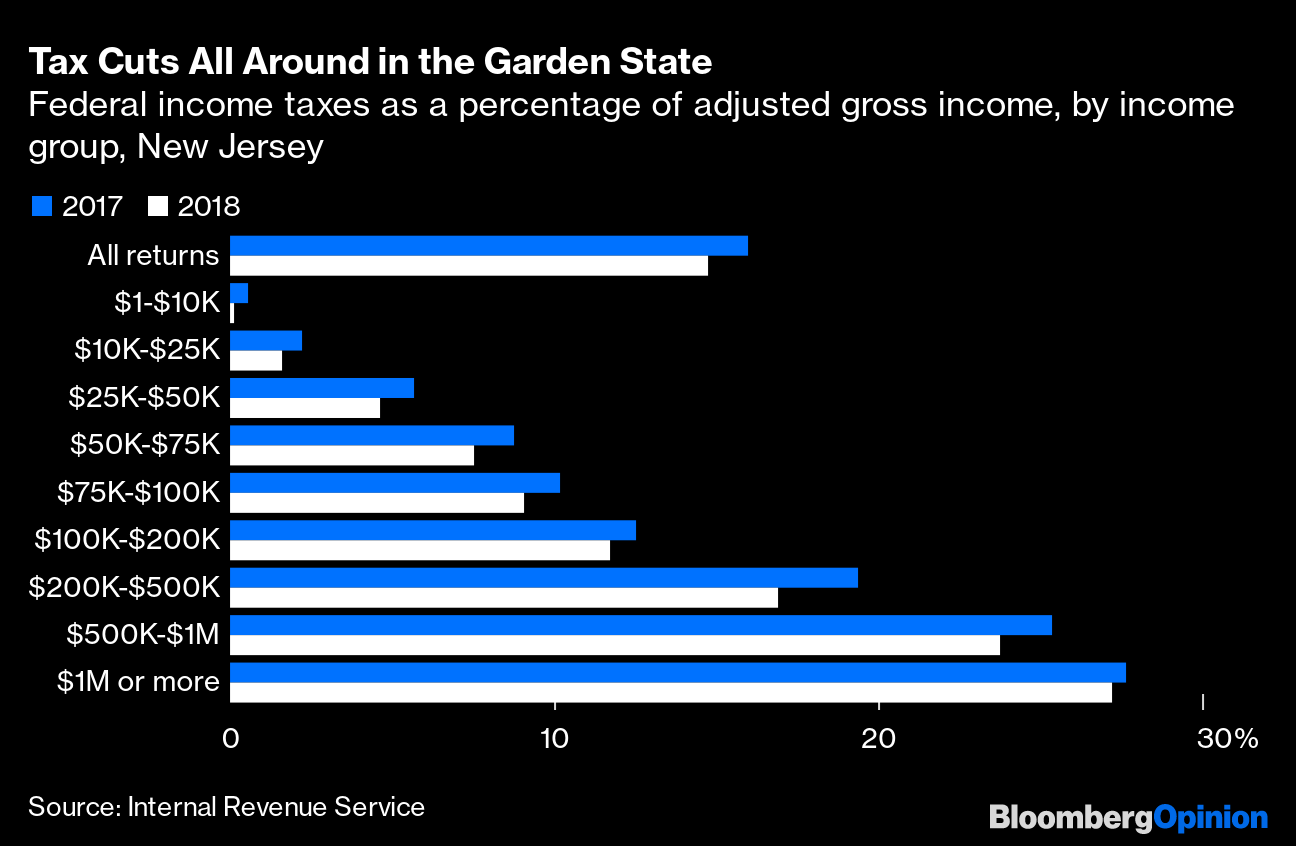

Everything Keeps Coming Up Roses For The 200 000 To 500 000 Set

House Of Representatives Passes Build Back Better Bill That Raises Salt Deductions Cap From 10 000 To 80 000 Cbs New York

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Urban Transporation Congestion Trends Sanjose Congestion Not Good Via Sanjosevoice Siliconvalley Congestion Urban Improve

Dems Somehow Pretend This Mostly Helps The Middle Class The Daily Postercommentsharecommentshare

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

End Of Prohibition 1933 Repeal Poster 12 X 18 Printed On High Quality Fuji Film Stock Film Fuji High End Of Prohibition Newspaper Printing Poster Prints

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

Among The Tax Bill S Biggest Losers High Income Blue State Taxpayers The New York Times